Investment Manager

- Available 24/7

- ***

- Invest with us

Infrastructure & Real Estate

Understanding Infrastructure

The term infrastructure first appeared in usage in the late 1880s. The word comes from French, with infra- meaning "below" and structure meaning "building."1 Infrastructure is the foundation upon which the structure of the economy is built, often times quite literally. In 1987, a panel of the U.S. National Research Council adopted the term “public works infrastructure” to refer to functional modes including highways, airports, telecommunications, and water supplies, as well as the combined systems that these elements comprise.

Applicable to large- and small-scale organizational frameworks, infrastructure can include a variety of systems and structures as long as there are physical components required. For example, the electrical grid across a city, state or country is infrastructure based on the equipment involved and the intent to provide a service to the areas it supports. Similarly, the physical cabling and components making up the data network of a company operating within a specific location are also the infrastructure for the business in question, as they are necessary to support business operations.

Applicable to large- and small-scale organizational frameworks, infrastructure can include a variety of systems and structures as long as there are physical components required. For example, the electrical grid across a city, state or country is infrastructure based on the equipment involved and the intent to provide a service to the areas it supports. Similarly, the physical cabling and components making up the data network of a company operating within a specific location are also the infrastructure for the business in question, as they are necessary to support business operations.

Because infrastructure very often involves the production of either public goods or goods that lend themselves to production by natural monopolies, it is very typical to see public financing, control, supervision, or regulation of infrastructure. This usually takes the form of direct government production or production by a closely regulated, legally sanctioned, and often subsidized monopoly. At smaller scales, infrastructure can also often take on the characteristics of club goods or goods most readily produced by localized monopolies, and can be provided within the context of a private firm producing infrastructure for use within the firm or provided by localized arrangements of formal or informal collective action.

Types of Infrastructure

Infrastructure can be put into several different types including:-

Soft Infrastructure

These types of infrastructure make up institutions that help maintain the economy. These usually require human capital and help deliver certain services to the population. Examples include the healthcare system, financial institutions, governmental systems, law enforcement, and education systems. Hard Infrastructure

These make up the physical systems that make it necessary to run a modern, industrialized nation. Examples include roads, highways, bridges, as well as the capital/assets needed to make them operational (transit buses, vehicles, oil rigs/refineries).Critical Infrastructure

These are assets defined by a government as being essential to the functioning of a society and economy, such as facilities for shelter and heating, telecommunication, public health, agriculture, etc. In the United States, there are agencies responsible for these critical infrastructures, such as Homeland Security (for the government and emergency services), the Department of Energy, and the Department of Transportation.

Along with the aforementioned sectors, infrastructure includes waste disposal services, such as garbage pickup and local dumps. Certain administrative functions, often covered by various government agencies, are also considered part of the infrastructure. Educational and healthcare facilities may also be included, along with specific research and development functions and necessary training facilities.

Understanding Real Estate Investment

Real estate has become a popular investment vehicle over the last 50 years or so. Here's a look at some of the leading options for individual investors, along with the reasons to invest.

Historical Prices

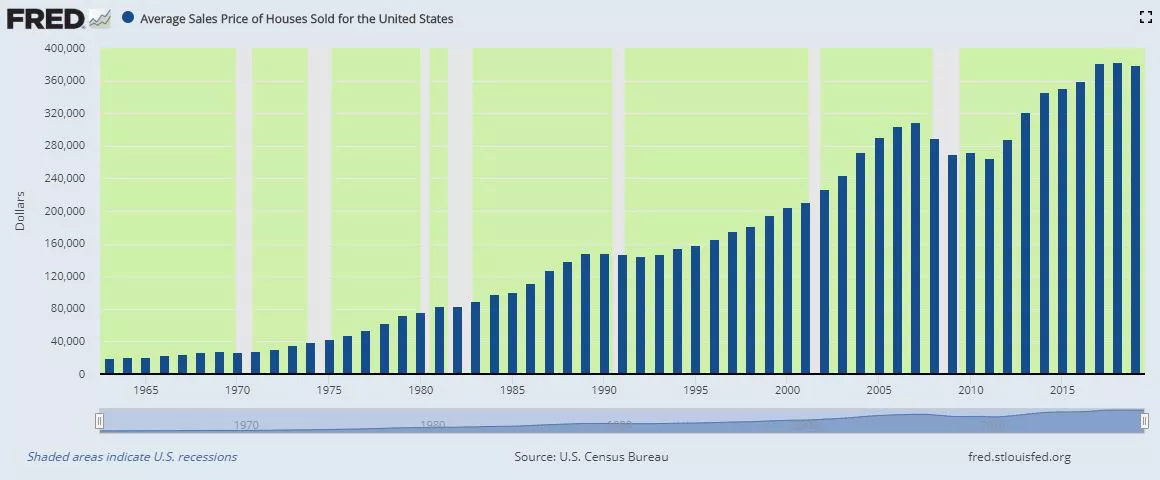

Real estate has long been considered a sound investment, and for good reason. Before 2007, historical housing data made it seem like prices could continue to climb indefinitely. With few exceptions, the average sale price of homes in the U.S. increased each year between 1963 and 2007—the start of the Great Recession.This chart from the Federal Reserve Bank of St. Louis shows average sales prices between 1963 and 2019 (the most recent data available).1 The areas that are shaded in light grey indicate U.S. recessions.

Of course, the most significant downturn in the real estate market before the COVID-19 pandemic coincided with the Great Recession. The results of the coronavirus crisis have yet to be seen. Amid closures, social distancing, and staggering unemployment numbers, it's likely that home sales will decline significantly. While that doesn't necessarily mean home prices will follow suit, it will at a minimum change the way people buy and sell real estate—at least in the short-term.

Flipping Houses

Like the day traders who are leagues away from buy-and-hold investors, real estate flippers are an entirely different breed from buy-and-rent landlords. Flippers buy properties with the intention of holding them for a short period—often no more than three to four months—and quickly selling them for a profit.

The are two primary approaches to flipping a property:

Repair and update. With this approach, you buy a property that you think will increase in value with certain repairs and updates. Ideally, you complete the work as quickly as possible and then sell at a price that exceeds your total investment (including the renovations).

Hold and resell. This type of flipping works differently. Instead of buying a property and fixing it up, you buy in a rapidly rising market, hold for a few months, and then sell at a profit.

With either type of flipping, you run the risk that you won't be able to unload the property at a price that will turn a profit. This can present a challenge because flippers don’t generally keep enough ready cash to pay mortgages on properties for the long term. Still, flipping can be a lucrative way to invest in real estate if it's done the right way.

Why Invest in Real Estate?

Real estate can enhance the risk-and-return profile of an investor’s portfolio, offering competitive risk-adjusted returns. In general, the real estate market is one of low volatility, especially compared to equities and bonds.

Real estate is also attractive when compared with more-traditional sources of income return. This asset class typically trades at a yield premium to U.S. Treasuries and is especially attractive in an environment where Treasury rates are low.

Diversification and Protection

Another benefit of investing in real estate is its diversification potential. Real estate has a low and, in some cases, negative, correlation with other major asset classes—meaning, when stocks are down, real estate is often up. This means the addition of real estate to a portfolio can lower its volatility and provide a higher return per unit of risk. The more direct the real estate investment, the better the hedge: Less direct, publicly traded vehicles, such as REITs, are going to reflect the overall stock market’s performance.