Investment Manager

- Available 24/7

- ***

- Invest with us

Energy Investment

What Is the Energy Sector?

The energy sector is a category of stocks that relate to producing or supplying energy. The energy sector or industry includes companies involved in the exploration and development of oil or gas reserves, oil and gas drilling, and refining. The energy industry also includes integrated power utility companies such as renewable energy and coal.

Understanding the Energy Sector

The energy sector is a large and all-encompassing term that describes a complex and inter-related network of companies, directly and indirectly, involved in the production and distribution of energy needed to power the economy and facilitate the means of production and transportation.

The companies within the energy sector are involved in various types of energy. For the most part, energy companies are often categorized based on how the energy that they produce is sourced and will typically fall into one-of-two categories:

- Non-renewable

- Petroleum products and oil

- Natural gas

- Gasoline

- Diesel fuel

- Heating oil

- Nuclear

- Renewable

- Hydropower

- Biofuels such as ethanol

- Wind power

- Solar power

The energy industry also includes secondary sources such as electricity. Energy prices—along with the earnings performance of energy-producers—are largely driven by the supply and demand for worldwide energy.

Oil and gas producers tend to perform well during periods of elevated oil and gas prices. However, energy companies earn less when the price of energy commodities falls. Oil refiners, on the other hand, benefit from the falling cost of feedstock to produce petroleum products like gasoline when crude oil prices drop. Furthermore, the energy industry is sensitive to political events, which historically have led to volatility—or wild fluctuations—in the price of oil.

Some of the largest companies in the U.S. energy sector include Exxon Mobil (XOM) and Chevron (CVX), both of which are large international integrated oil companies. In 2019, Peabody Energy (BTU) was America's largest coal producer measured by tons of output.

Types of Energy Sector Companies

Below are some of the types of companies found in the energy industry. Each has a distinct role to play in bringing energy to businesses and consumers.

Oil and Gas Drilling and Production

These are the companies that drill, pump, and produce oil and natural gas. Production typically involves pulling oil out of the ground.

Pipeline and Refining

Oil and natural gas must be delivered from the production site to a refinery to be refined into a final product such as gasoline. Companies within this portion of the energy sector are called mid-stream providers.

Mining Companies

Coal companies could be classified as energy companies since coal is used to power plants, including nuclear.

Renewable Energy

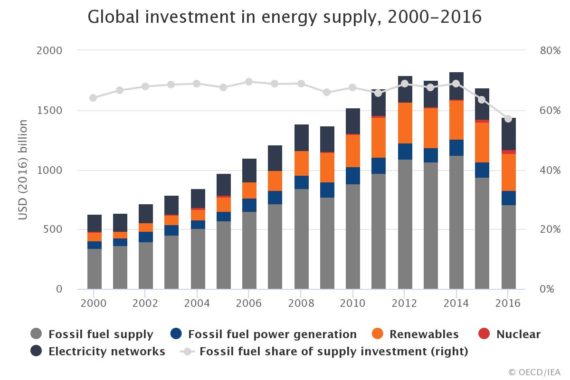

Clean energy has gained traction and investment dollars over the years and is likely to be a growing part of the energy sector in the future. Examples of renewable energy include wind and solar.

Chemicals

Some companies specialize in refining oil and gas into specialty chemicals, although many larger oil producers such as Exxon Mobil are integrated energy producers, meaning they produce multiple types of energy and control the entire process.

Examples of Energy Sector Investments

Investors have numerous choices for investment opportunities in the energy industry, including equities of energy companies, mutual funds, ETFs as well as the ability to buy the commodities.

Exchange-traded funds (ETFs) are a basket of investments, such as stocks, that track an underlying index. Mutual funds, on the other hand, are a portfolio of stocks or investments that are selected and managed by a portfolio manager.

There are a number of energy-related ETFs that retail investors can gain exposure to in the energy industry. Investors can choose which part of the value chain they want exposure to with any number of funds. Below are a few examples of energy ETFs:

The Energy Select Sector SPDR ETF (XLE) is a broad-based ETF that provides exposure to energy companies across the sector. Oil producers like Exxon Mobil and Chevron are in the XLE as well as technology suppliers like Schlumberger (SLB).

The SPDR S&P Oil & Gas Exploration & Production ETF (XOP) provides investors with exposure to oil and gas exploration companies.

The VanEck Vectors Coal ETF (KOL) provides access to the coal industry.

The Invesco Solar ETF (TAN) provides investors access to alternative energy investments.

How investors choose to invest in the energy sector will likely depend on their preferences and specific views about the growth and earnings prospects of the various companies. The energy industry is more extensive and diversified than merely the oil and gas industry. Many investors believe renewable and alternative energy sources will play an important role in the future, especially as the demand for electric cars continues to grow.